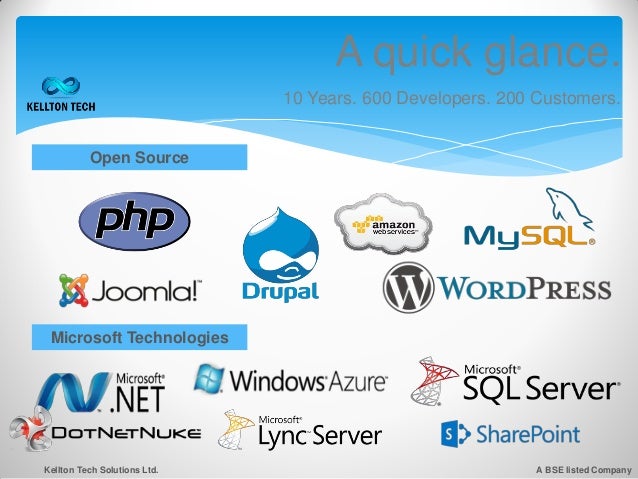

Kellton Tech is a global IT company with a portfolio comprising an exhaustive list of IT services in the web, mobile, security, ERP and cloud Space. Kellton Tech boasts a global presence spanning three continents, three countries and five cities. Created with a vision to offer infinite possibilities with technology we are committed to providing end-to-end IT solutions, strategic technology consulting and product development services.

Founded in 1993, Kellton Tech was created to offer infinite possibilities with technology. Interestingly, the word "Kellton" is derived from combining the school names Kellogg and Wharton - the alma maters of two of our founding members. In the last twenty years, Kellton Tech has come a long way, and has grown both organically and inorganically. The acquisition of three leading companies over the last three years (Tekriti Software, MCS Global and DbyDx Software) has added exponentially to Kellton Tech's knowledge and expertise.

Kellton Tech has over 4 years experience in Social Networking Software, creating world class platforms for facilitating networking between individuals or organizations based on a common grounds interest, profession, values, ambition, kinship, products and services.

Over this period Kellton Tech has deployed over a dozen Social Networking Software. Kellton Tech's expertise lies in making robust and scalable platforms based on innovative features that capture user interests.

Buy Kellton Tech Solutions for long term basis:

2. Company has very widely known clients like PVR , makemytrip DailyNews Newyork, Educomp, Nokia, Kaplan, Nielsen. Company provides quality solutions to the world's widely known companies.

3. Kellton Tech Selected Among the 'Top 20 Travel & Hospitality Solution Provider in June 2014.

4. Company's financial cyclefrom July to June. Consolidated net sales of Rs 48.6 Crs and PAT of Rs 3.7 Crs in FY 13. For first 3 quarters FY 14, Net Sales of Rs 91.8 Crs and PAT of Rs 3.83 Crs....full year FY 14 nos. to be much higer than Fy 13.

5.Promoters increased their shareholding by subscribing to the warrants at Rs 15 per share and they haven't pledge a single share till date.

Disclosure: Invested at 15rs, Accumulation and avg price at 20.45

1. Company provides end to end solution in the growing IT sector like ERP, cloud and mobile sector. We believe this choice of growing sector will help company to generate increasing revenue in coming quarters.

2. Company has very widely known clients like PVR , makemytrip DailyNews Newyork, Educomp, Nokia, Kaplan, Nielsen. Company provides quality solutions to the world's widely known companies.

3. Kellton Tech Selected Among the 'Top 20 Travel & Hospitality Solution Provider in June 2014.

5.Promoters increased their shareholding by subscribing to the warrants at Rs 15 per share and they haven't pledge a single share till date.

My View-

I expect company to post EPS into similar lines for rest of the Financial year which makes it 2.9 for the entire year. At CMP of 20.5 company is trading at the PE multiple of 7-8. Further, company has taken lot of acquisition on the book pursuing aggressive expansion strategy. (FYI - It acquired Kellton tech from USA and changed their own name to Kellton tech to focus better on their US market.) Further, promoters are steadily increased their stake in the company which shows their commitment to the company. We consider company is currently in the infant stage and has lot of potential to grow into multifold return. Hence I recommend this stock for long term investment at CMP 21.5.

Disclosure: Invested at 15rs, Accumulation and avg price at 20.45

2 comments:

Hi,

Why has the management got its foot in so many other sectors and companies. For example the management has many other companies like below:

KELLTON COMMODITY AND DERIVATIVES PRIVATE LIMITED

Kellton Infra Private Limited

KELLTON FINANCIAL SERVICES PRIVATE LIMITED

KELLTON INSURANCE SERVICES PRIVATE LIMITED

KELLTON SECURITIES PRIVATE LIMITED.

Do you have a view on this? It doesn't inspire much confidence that management has its hands into so many things

No worries.

Post a Comment