Having learnt from both Warren Buffet and Phil Fisher, I have added to my own one of a kind style of stock examination that includes around 40% of investigation on the ground. I would like to call this the Holmesian way of analysing stocks - unlike conventional analysis that relies heavily on secondary research, this creates a double loop mechanism that feeds into the other engine and helps validate or reject the thesis. This has often proven to be quite an advantage in micro caps where often “what you see is not what you get in the numbers” and vice versa.

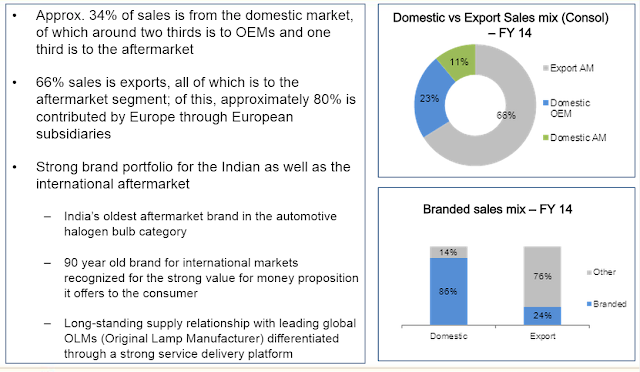

Phoenix Lamps Ltd. ( Previously known as Halonix Ltd.) is a manufacturer of automotive halogen bulbs in India with an approximate market share of 50% in Passenger Vehicles, 70% in commercial vehicles and 70% in two Wheeler OEMs . The company is the largest manufacturer in India and also claims to be among top five globally. A near monopoly business in automotive head lamps/tail lamps gone terribly awry through a diversification into CFL’s which is cut throat, high intensity, B2C, branding heavy business. A decade later and the mistake corrected through a slump sale of the loss making CFL business Though there has been slowdown in automotive industry, but the overall long-term outlook remains positive. Phoenix Lamps Ltd., being market leader in this business is expected to grow along with the industry.

A look at the ratios and you will be impressed. High RoE, high ROCE, FCF positive business with high asset turns (11 x FA turns) with a 20 % + EBITDA margin with ROCE of 30 % +. It’s got near FMCG characteristics given the standard nature (A friend at bosch says the key to a higher margin business in auto is a. high standardization b. high value to weight/volume c. OEM + after market possibilities and that’s why bosch is always in things like ABS, wipers, air bags which are critical parts and fairly standard. The only exception are high finesse items which involve a lot of high

end labour like machining and critical engine parts.

Recently Suprajit engineering has acquired 51% of Phoenix Lamps (PL) from

a PE investor at agreed price of Rs 89/share with an

option to increase the stake to 62% later and this got me delving deeper again. Let’s get the easy one out of the way –actis has been stuck in the company for 9 years and started selling down their shares (from 70 % to 60 % ) and this has resulted in the share price going down from Rs. 180 to Rs. 100 over six months with no change in fundamentals. That’s gone and a simple reversion to mean should take this atleast 50 % up.

Suprajit is well known to value investors in the indian market. I have personally interacted with ajit rai and I think he is an outsider CEO – buys cheap and is an exceptional operator with a focus on bottom line and cash flows. He has been looking at acquisitions for long and finally bought one which in his own words was a company that manufactures : Scalable, global standardized product, With a market leadership position in india market, With export possibilities, Complementary to his core business of two wheeler cables, High margins and strong cash flows with minimal debt. Given what he has done with suprajit – have a look at ROIC of 30 % consistently and his own salary/remuneration etc. and I am sure that he will do a good job of at least maintaining status quo – which by itself should lead to a re-rating.

Concluding:

Phoenix Lamps Ltd is a manufacturer of automotive halogen bulbs in India with a dominant market share. The “General Lighting” business of the company had been a drag on its financial performance for several years but that business has been sold on a slump sale. From now on the company is expected to post consistent profits on its Automotive Lamps business. Due to buoyant market conditions and Special dividend, the stock is trading at very fair valuations for the expected earnings. Suprajit management is generally reputed to be fair & honest. They have indicated that they will at some point in the future merge the two companies and there will always be a question mark on the merger ratio until the event happens Currently the stock offers little valuation discount. I see little downside here given the open offer at Rs. 100/share and a 2-3 x upside.

5 comments:

Sir

I am holding umang dairies at @ 58 . could you please share your thoughts on its target .

Thanks for your GTS 2

Advice on vinyl chemical plz.

@ Sanjeev, I do not set target for multibaggers. Please read the link:

http://valuefundamentalinvestor.blogspot.in/2014/10/point-of-note-for-new-investors.html

@ Saurin,

I personally really like vinyl chemicals, add more on major declines for a longer term outlook.

Sir how about delta corp

Delta corp hold

Post a Comment